Each 10-K a

company files includes an Auditor’s Report. In that letter, addressed to the

shareholders of the company, the auditors give their opinion on the attached

financial statements. The auditors also opine on the companies’ internal

controls over the financial reporting. In writing the report, auditors typically

follow

a standard format.

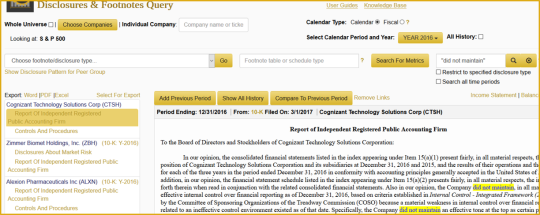

You can easily

use Calcbench’s disclosure query to search the

auditor’s reports and identify companies for which the auditor found some

issues. For example, choosing the S&P 500 companies in 2016, and searching

for the text “did not maintain” would identify 5 companies (ALXN, BLL, CTSH,

EBAY, ZBH) in which auditors that found the firm ‘did not maintain’ appropriate controls over

the financial reporting.

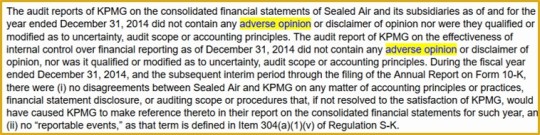

Some auditors use different text, so you may want to look at “expressed an adverse opinion” or “adverse opinion”. This would produce some more companies (see below).

The auditor’s report includes a treasure trove of information. At Calcbench, we extract some information out of it and offer it to our users. For example, you can use the multi-company viewer to uncover the auditor (variable name: auditor_name) for companies you are interested in. And new this year, you can see how long they have been auditing the company, also known as the auditor tenure (variable name: auditor_since_year).